Access Control Advantage

The new standard in defined contribution plan loan administration

WHY ACA

ACA can lower plan administration costs, eliminate loan repayment through payroll processing, reduce participant borrowing, enable faster loan repayment, keep more assets in the plans and encourage employee participation. ACA works for 401k plan loans, 457 plan loans, 403b plan loans.

INCREASE RETIREMENT SAVINGS WITH ACA

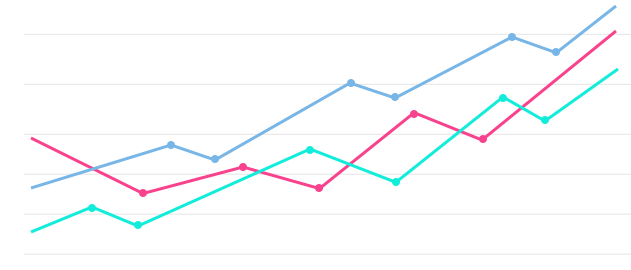

REDUCE BORROWING, INCREASE RETIREMENT SAVINGS

FOR RECORDKEEPERS

FOR RECORDKEEPERS

Reduce plan leakage. Increase asset retention. Create recurring revenue.

FOR PLAN SPONSORS

FOR PLAN SPONSORS

Improve employee benefits. Reduce operational burden. Protect your employees.

FOR PLAN PARTICIPANTS

FOR PLAN PARTICIPANTS

Save more for retirement by borrowing only what you need, when you need it.

HOW ACA WORKS

Embrace the 12% advantage.

We have found through 401k recordkeepers and others that use ACA that ACA loan balances are, on average, 12% lower than traditional retirement loans, and 30% of ACA loan repayments are higher than the minimum required. ACA can be integrated into any recordkeeping platform.